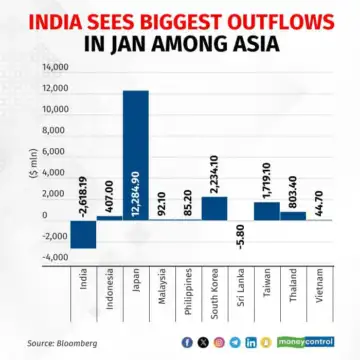

Indian equity markets have seen highest outflows in Asia in January, with foreign institutional investors (FIIs) pulling out $2.62 billion from Indian exchanges.

This was the highest monthly outflow since January 2023.

In January, the Sensex was down 0.4 percent, while Nifty gained 0.05 percent. Other Asian countries also experienced losses: Hang Seng fell by 5.8 percent, Shanghai declined 4.3 percent, Kospi lost 9 percent, and Jakarta 4.2 percent. Meanwhile, the Topix index rose 2 percent, while Nikkei advanced by 2.6 percent.

Apart from India, Sri Lanka saw outflows of $6 million, this month. However, other Asian countries saw inflows. Japan led with the highest equity inflows of $12.28 billion, followed by South Korea and Taiwan with $2.23 and $1.72 billion, respectively.

Thailand got around $803.4 million, Indonesia received around $407 million in inflows, Malaysia $92 million, Philippines $85.2 million, and Vietnam $45 million. China’s foreign fund flow data is not updated. According to a recent Kotak report, China saw inflows of $10.8 billion in December 2023.

According to Rajesh Palviya, Analyst, Axis Securities, the Indian outflow has been because of subdued corporate earnings visa-vis valuations, which has made investors cautious.

Analysts noted that FII selling in India was particularly triggered by HDFC Bank’s results. Additionally, the rise in US treasury yields prompted FIIs to book profits in the Indian markets. Analysts further said that across the globe, markets have been volatile due to the situation in the Middle East, and its impact on global growth and inflation.

Globally, attention is on the next meeting of the US FOMC (Federal Open Market Committee) on January 30-31, 2024. With the expectation that there will be no rate cut, the focus is on the commentary as the macroeconomic data shows improvement, said Neeraj Gaurh, Fund Manager, Axis Securities, PMS .

Analysts are optimistic about the Indian economy, and foresee financial stability and sustainable growth. The outlook includes expectations of manageable inflation and a stable cost of borrowing. Despite limited fiscal space, the government is urged to maintain a delicate balance between fiscal deficit and growth through government capex. While new market highs bring excitement, analysts caution against potential geopolitical risks. They emphasise that earnings growth, rather than valuation re-rating, will be the key driver for the markets.

According to Deepak Jasani, Analysts, HDFC Securities, Indian equities may continue to see volatile times in the first half of 2024 due to the elections and a global change in central banks’ views on interest rates. Sell-offs can result in bargain buying by existing and new players as the view on India remains positive, while profits can be booked when stock prices rise, he added.

SEBI’s additional disclosures

Recent news reports suggested that FIIs in India are selling to adhere to SEBI’s enhanced disclosure norms aimed at preventing manipulation of minimum public shareholding (MPS) rules, and avoiding indirect control of Indian companies by overseas entities through shell firms. However, some news reports also suggested that the granular details of beneficial ownership required from FIIs may be lower than initially asked for in SEBI’s consultation paper.

In 2023, SEBI mandated additional disclosures for FIIs holding over 50 percent of their Indian equity AUM (assets under management) in a single corporate group, or with over Rs 25,000 crore in AUM in Indian markets, with the goal of protecting investors against potential circumvention of MPS rules.

Disclaimer:The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Hundreds of Indian students facing ‘deportation’ from Canada stage protest

Hundreds of Indian students facing ‘deportation’ from Canada stage protest