New Delhi: Often it has been observed that salaried individuals (mostly non-government employees), who do not get pension from their employers, face financial scarcity if their retired life gets stretched beyond 10-15 years.

Because they mostly park their hard-earned savings in fixed deposits to protect their retirement corpus.

As inflation in India has remained historically high, the purchasing power of the interest income that retirees get from their fixed deposit investments diminishes with every passing year. Also, as the long term interest rate trajectory in India is witnessing a declining trend, retirees’ interest income has been falling continuously and they are forced to withdraw from the principal to meet their expenses.

In order to avoid such a situation, financial planners advise young earners to invest their savings in equity-oriented or hybrid instruments (that invest in both equity and debt) so that they can accumulate a large corpus for their retirement. National Pension System (NPS) is such an instrument which can help young earners accumulate a large corpus for their retirement by investing smaller amounts every month.

By investing in NPS you will get a fixed monthly pension till you are alive and also a lumpsum amount at the time of retirement. Tax and investment expert Balwant Jain says, a subscriber can withdraw maximum 60% of his maturity corpus from NPS as a tax-free lump sum and with the remaining amount he/she has to buy a annuity from a life insurance company, which on average give annuity at an annual rate of 5-6% if you choose return of premium option.

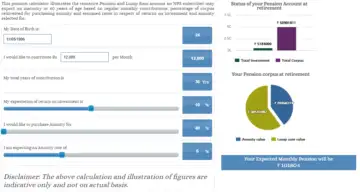

NPS gives you multiple fund options where you can choose between a mix of debt and equity where the maximum equity component can not exceed 75% of the investment amount. According to Jain, one can expect 10-11% annual return in the longer term if he allocates 75% of his investment in NPS to equities and 25% to debt.

Source: npstrust.org.in

Source: npstrust.org.in

So if you start investing early, as soon as you get a job, let say at the age of 24, when most people start working, in NPS then you can easily accumulate a retirement corpus of over Rs 5 crore (Check NPS calculator above) by your retirement age (60 years) by investing just Rs 300 a day or Rs 12,000 monthly. Out of the retirement corpus, you can withdraw 60% or Rs 3.05 crore as lump sum and the remaining 40% or Rs 2.04 crore needs to be used for purchasing an annuity. Assuming 6% annuity return, you will get Rs 1 lakh monthly pension after your retirement.

“One should invest at least Rs 50,000 in NPS every year so that he can avail tax deduction on the amount u/s 80CCD (1B) over and above the Rs 1.5 lakh annual limit under Section 80C,” said Jain.

Boost your retirement income further by investing the lump sump amount in mutual funds

Worth mentioning here is that you can boost your retirement income further if you park the lump sum amount in an equity savings fund and withdraw a fixed amount from that fund every month through Systematic Withdrawal Plan (SWP). It may be noted that equity savings funds invest in equity, equity arbitrage positions, and debt with minimum 65% exposure to equity-related instruments. While these funds generate higher return than debt funds in the longer term with lower volatility, they also enjoy tax benefits of an equity fund. It means long term capital gains from equity savings funds are taxed at 10% once you cross the Rs 1 lakh threshold.

In this process, you can withdraw another Rs 1.5 lakh every month through SWP while ensuring that your capital or investment amount of Rs 3 crore also grows. According to Value Research, past 10-year annualised returns of equity savings funds have been more than 8%. If we assume that these returns will be maintained in the future as well then your investment amount will continue to grow even if you withdraw 6% of the corpus (Rs 3 crore) annually through SWP (Rs 1.5 lakh*12).

Driving Naari Programme launched in Chandigarh

Driving Naari Programme launched in Chandigarh