Reliance Industries | Unit Reliance Strategic Business Ventures has acquired a 23.3 percent stake in US-based Exyn Tech for $25 million.

Reliance Industries | Unit Reliance Strategic Business Ventures has acquired a 23.3 percent stake in US-based Exyn Tech for $25 million.

The unit and Exyn have also signed a strategic partnership for technology collaboration and commercialisation of Exyn’s technology. More details here.

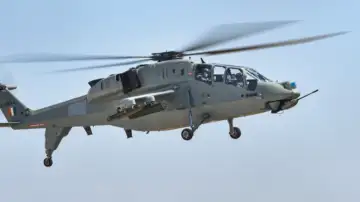

Defence Stocks | The Defence Acquisition Council has approved acceptance of necessity for 24 capital acquisition proposals worth Rs 84,328 crore for the armed forces and Indian Coast Guard. 21 of those, worth Rs 82,127 crore will be procured from Indigenous sources.

Defence Stocks | The Defence Acquisition Council has approved acceptance of necessity for 24 capital acquisition proposals worth Rs 84,328 crore for the armed forces and Indian Coast Guard. 21 of those, worth Rs 82,127 crore will be procured from Indigenous sources.

JK Cement | The company on Thursday announced its foray into the paints business by acquiring a 60 percent stake in Rajasthan-based Acro Paints in a Rs 153 crore deal through its wholly-owned subsidiary. The remaining 40 percent will be acquired over the next 12 months. More details here.

JK Cement | The company on Thursday announced its foray into the paints business by acquiring a 60 percent stake in Rajasthan-based Acro Paints in a Rs 153 crore deal through its wholly-owned subsidiary. The remaining 40 percent will be acquired over the next 12 months. More details here.

Zydus Lifesciences | The company on Thursday said its subsidiary Zydus Worldwide DMCC has received final approval from the US health regulator to market its generic version of Selexipag tablets with 180 days of shared exclusivity. The approval granted by the US Food and Drug Administration (USFDA) is to market Selexipag tablets of strengths ranging from 200 mcg to 1,600 mcg.

Zydus Lifesciences | The company on Thursday said its subsidiary Zydus Worldwide DMCC has received final approval from the US health regulator to market its generic version of Selexipag tablets with 180 days of shared exclusivity. The approval granted by the US Food and Drug Administration (USFDA) is to market Selexipag tablets of strengths ranging from 200 mcg to 1,600 mcg.

Rail Vikas Nigam | Awarded contract for construction of Bhesan depot cum workshop for the Surat Metro Rail Project Phase – 1 by the Gujarat Metro Rail Corporation. The total awarded cost of the project is Rs 198.9 crore, excluding taxes.

Rail Vikas Nigam | Awarded contract for construction of Bhesan depot cum workshop for the Surat Metro Rail Project Phase – 1 by the Gujarat Metro Rail Corporation. The total awarded cost of the project is Rs 198.9 crore, excluding taxes.

Lupin | The company’s US-based arm is recalling four lots of Quinapril tablets used to treat high blood pressure due to the presence of a nitrosamine impurity. The nitrosamine impurity, N-Nitroso-Quinapril, was observed in recent testing to be above the acceptable daily intake (ADI) level. “To date, Lupin has received no reports of illness that appear to relate to this issue,” it said, adding it discontinued marketing of Quinapril tablets in September 2022.

Lupin | The company’s US-based arm is recalling four lots of Quinapril tablets used to treat high blood pressure due to the presence of a nitrosamine impurity. The nitrosamine impurity, N-Nitroso-Quinapril, was observed in recent testing to be above the acceptable daily intake (ADI) level. “To date, Lupin has received no reports of illness that appear to relate to this issue,” it said, adding it discontinued marketing of Quinapril tablets in September 2022.

Biocon | Issued a Good Manufacturing Practice (GMP) certificate of compliance by the European Directorate for Quality of Medicines and Healthcare (EDQM) for its Active Pharmaceutical Ingredients (API) manufacturing facility in Bengaluru. The inspection of the site was conducted between September 12-14, 2022.

Biocon | Issued a Good Manufacturing Practice (GMP) certificate of compliance by the European Directorate for Quality of Medicines and Healthcare (EDQM) for its Active Pharmaceutical Ingredients (API) manufacturing facility in Bengaluru. The inspection of the site was conducted between September 12-14, 2022.

Bank of Maharashtra | The state-owned lender has raised Rs 880 crore through Basel III-compliant Additional Tier 1 (AT1) bonds. The issue, including the green shoe option of Rs 680 crore, was subscribed more than four times against a base size of Rs 200 crore. The fund raised through the AT1 bonds will support the business growth of the bank.

Bank of Maharashtra | The state-owned lender has raised Rs 880 crore through Basel III-compliant Additional Tier 1 (AT1) bonds. The issue, including the green shoe option of Rs 680 crore, was subscribed more than four times against a base size of Rs 200 crore. The fund raised through the AT1 bonds will support the business growth of the bank.

Punjab National Bank | The CBI has registered an FIR against an officer of Punjab National Bank (PNB), now suspended, for allegedly cheating the state-run lender to the tune of Rs 168.59 crore through 34 fake bank guarantees, officials said Thursday. Nearly four years after LoU (letter of undertaking) scam allegedly perpetrated by the uncle-nephew duo of Mehul Choksi and Nirav Modi bled the PNB to the tune of about Rs 13,000 crore, bank official Priya Ranjan Kumar followed a similar modus operandi to issue 34 fake bank guarantees without making any entries in its core banking system Finacle, according to the CBI FIR.

Punjab National Bank | The CBI has registered an FIR against an officer of Punjab National Bank (PNB), now suspended, for allegedly cheating the state-run lender to the tune of Rs 168.59 crore through 34 fake bank guarantees, officials said Thursday. Nearly four years after LoU (letter of undertaking) scam allegedly perpetrated by the uncle-nephew duo of Mehul Choksi and Nirav Modi bled the PNB to the tune of about Rs 13,000 crore, bank official Priya Ranjan Kumar followed a similar modus operandi to issue 34 fake bank guarantees without making any entries in its core banking system Finacle, according to the CBI FIR.

Ingersoll Rand (India) | Board approves setting up new manufacturing plant in Gujarat. Plant to be established at an expense of `170 crore.

Ingersoll Rand (India) | Board approves setting up new manufacturing plant in Gujarat. Plant to be established at an expense of `170 crore.

Yes Bank | The bank has transferred invoked shares of seven companies, including Dish TV, Asian Hotels (North) and Avantha Realty, to JC Flowers Asset Reconstruction, which has been assigned to recover debt worth over Rs 48,000 crore of the private sector lender. The invoked equity shares held by Yes Bank aggregating to 44,53,48,990, representing 24.19 percent of the total share capital of Dish TV India, have now been transferred to JC Flowers Asset Reconstruction Pvt. Ltd. The transfer of invoked shares is pursuant to the assignment of loans sanctioned by the bank to Essel group companies (in respect of which default is subsisting and pledge on company’s shares was invoked by Yes Bank).

Yes Bank | The bank has transferred invoked shares of seven companies, including Dish TV, Asian Hotels (North) and Avantha Realty, to JC Flowers Asset Reconstruction, which has been assigned to recover debt worth over Rs 48,000 crore of the private sector lender. The invoked equity shares held by Yes Bank aggregating to 44,53,48,990, representing 24.19 percent of the total share capital of Dish TV India, have now been transferred to JC Flowers Asset Reconstruction Pvt. Ltd. The transfer of invoked shares is pursuant to the assignment of loans sanctioned by the bank to Essel group companies (in respect of which default is subsisting and pledge on company’s shares was invoked by Yes Bank).

NTPC | The company on Thursday said it has inked an agreement with GE Power India Ltd to reduce carbon emissions from its coal-fired units. This agreement aims at partnering on research, development and engineering of technologies that will enable NTPC to reduce the amount of coal-fired at units and gradually replace it by co-firing of carboneous and non-carboneous elements.

NTPC | The company on Thursday said it has inked an agreement with GE Power India Ltd to reduce carbon emissions from its coal-fired units. This agreement aims at partnering on research, development and engineering of technologies that will enable NTPC to reduce the amount of coal-fired at units and gradually replace it by co-firing of carboneous and non-carboneous elements.

Driving Naari Programme launched in Chandigarh

Driving Naari Programme launched in Chandigarh