(PTI) The rupee closed flat at 82.03 (provisional) against the US dollar in a restricted trade on Friday amid a rally in the domestic equities and firm crude oil prices.

While FII inflows into equities supported the rupee, a firm US dollar in global markets and gains in crude oil prices capped its gains, analysts said.

The rupee opened weak at 82.05 at the interbank foreign exchange market due to firm crude oil prices in the Asian trade. It moved in a tight range of 82.00 to 82.07 in the day trade.

The local unit settled flat at 82.03 (provisional) against the US dollar. The rupee closed at the same level on Wednesday.

Forex markets were closed on Thursday on the occasion of the Bakrid holiday.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, firmed up by 0.09 per cent to 103.43 on growing expectations of further interest rate hikes by the US Federal Reserve.

Traders expect the US Federal Reserve to raise interest rates further after a pause in June following a strong set of US economic data.

According to data released on Thursday, the US economy grew stronger than anticipated at 2 per cent in the first quarter of this year while fewer jobless claims that the job market remains solid despite much higher interest rates meant to slow the overall economy.

Global oil benchmark Brent Crude was trading 0.61 per cent higher at USD 74.79 per barrel.

In the domestic equity market, benchmark indices Sensex and Nifty hit their all-time high on Friday. The 30-share BSE Sensex closed at a record high of 64,718.56, and the Nifty scaled the peak of 19,189.05 points amid fresh foreign fund inflows.

Foreign Portfolio Investors emerged as net buyers in the capital market on Wednesday as they bought shares worth ₹12,350 crore, according to exchange data.

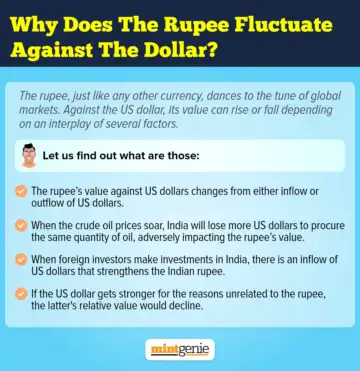

We explain here why does the rupee fluctuate against the dollar

We explain here why does the rupee fluctuate against the dollar

Driving Naari Programme launched in Chandigarh

Driving Naari Programme launched in Chandigarh