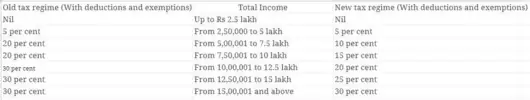

Finance minister Nirmala Sitharaman tabled Union Budget 2022-23 in Parliament on February 1. The finance minister did not announce any change in personal income tax slabs and rates in Budget 2022. Thus, with no change in the income tax rates and slabs, an individual taxpayer will continue to pay the same rate of tax depending on the tax regime chosen for FY 2022-23.

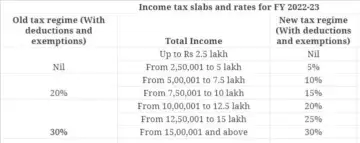

Current Income Tax slabs for Individual (resident or non-resident), 60 years or more but less than 80 years of age anytime during the previous year:

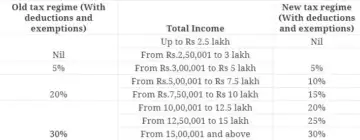

Current Income Tax Slabs for Individual (resident or non-resident) 80 Years of Age or More Anytime During the Previous Year:

Current Income Tax Slabs for Individual (resident or non-resident) 80 Years of Age or More Anytime During the Previous Year:

Effective from April 1, 2020, an individual salaried taxpayer has been given the option to continue with the old tax regime and avail deductions/tax exemptions such section 80C, 80D deductions, HRA, LTA tax exemptions etc.

Effective from April 1, 2020, an individual salaried taxpayer has been given the option to continue with the old tax regime and avail deductions/tax exemptions such section 80C, 80D deductions, HRA, LTA tax exemptions etc.

or to opt for the new tax regime and forgoing approximately 70 deductions and tax exemptions. The new tax regime offers lower tax rates as compared to the old tax regime.

Under both income tax regimes, a tax rebate of up to Rs 12,500 is available to an individual taxpayer under section 87A of the Income-tax Act, 1961. This would effectively mean that individuals having net taxable income of up to Rs 5 lakh would not pay any income tax irrespective of the tax regime chosen by them.

Another thing to keep in mind is that under the old tax regime, the basic tax exemption limit for an individual taxpayer depends on their age and residential status. However, in the new tax regime, the basic exemption limit is Rs 2.5 lakh in a financial year.

There are two important points to be noted as per the Income Tax Department’s website:

-The rates of surcharge and health and education cess are same under both the tax regimes (old and new).

-Rebate u/s 87 – A Resident Individual whose Total Income is not more than Rs 5,00,000 is also eligible for a Rebate of up to 100 per cent of income tax or Rs 12,500, whichever is less. This Rebate is available in both tax regimes.

In the Union Budget 2021, the finance minister Nirmala Sitharaman announced that senior citizens above the age of 75 years, who only have pension and interest as a source of income will be exempted from filing the income tax returns. During her budget speech, Sitharaman said, “In the 75th year of Independence of our country, the government shall reduce compliance burden on senior citizens who are 75 years of age and above.”

It must be noted that the senior citizens who are above 75 years age, are not exempted from paying tax but only from filing income tax return (ITR) if they are eligible to certain conditions. The exemption from filing income tax returns would be available only in case where the interest income is earned in the same bank where pension is deposited.

Driving Naari Programme launched in Chandigarh

Driving Naari Programme launched in Chandigarh