Rating agency CRISIL on Tuesday (September 12) said its arm CRISIL Ratings Ltd unveiled a plan to establish a new step-down subsidiary named CRISIL ESG Ratings & Analytics Ltd.

The subsidiary’s primary focus will be on the business of Environmental, Social, and Governance (ESG) ratings.

However, it’s important to note that the creation of CRISIL ESG Ratings & Analytics is contingent upon obtaining approvals from regulatory bodies, including the Securities and Exchange Board of India (SEBI), and other relevant statutory authorities.

CRISIL Ratings will provide cash consideration to the proposed subsidiary in exchange for a 100 percent shareholding. This share subscription will be conducted through cash payments. The establishment of CRISIL ESG Ratings & Analytics Ltd is expected to be completed by the end of 2023, specifically by December 31, 2023.

Vedanta and Anil Agarwal face multiple challenges as company seeks to escape the debt trap

Further, CRISIL intends to transfer its ESG Scores business to this new entity, CRISIL ESG Ratings & Analytics, through a slump basis arrangement, as outlined in the Business Transfer Agreement (BTA).

The effective date for completion of the sale will be determined under the BTA which will be executed post and subject to, receipt of a certificate of registration from SEBI.

‘The ESG Scores business being in its initial phase has seen significant upfront investment in building a strong team to establish ESG assessment framework, ensure smooth ramp up of coverage, support wide customer reach together with investments in technology and other systems and processes,’ CRISIL said.

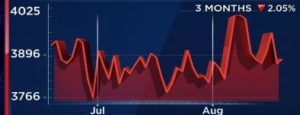

Shares of CRISIL Ltd ended at Rs 3,850.00, down by Rs 71.00, or 1.81 percent on the BSE.

Driving Naari Programme launched in Chandigarh

Driving Naari Programme launched in Chandigarh