A 7 percent rally in crude oil prices took the chart to its highest level in seven months. And, then came the big news. Aramco, the world’s biggest oil refiner, is reportedly planning a $50 billion share sale at a time when crude oil prices are expected to rise significantly.

Now, on the morning of September 4 in India, global crude oil is at its highest in nine months.

According to a Wall Street Journal report citing sources, the follow on sale of shares to the public may take place before the year end, in Riyadh stock market. This is the third share sale by the company, owned by the Kingdom of Saudi Arabia, since its initial public offering (IPO) in 2019.

High oil prices are good for Aramco because higher the price, better the valuation for its shares. Saudi Arabia had earlier decided to delay the share sale citing poor market conditions. At the end of June 2023, Aramco’s profit was down 38 percent to $30.1 billion due to pressure on crude oil prices.

Expectations are that oil prices may rise even further. Barclays, for instance, estimates that crude oil may cost as much $97 a barrel in 2024. Earlier in August, the Saudi Press Agency said, citing sources, that the kingdom plans to cut oil output by a billion barrels a day.

Goldman Sachs expects oil prices at $93 a barrel in the next 12 months. Watch this interview for the rationale provided by Daan Struyven, who leads the research on oil markets at the global investment bank.

The official decision is yet to be announced and if it comes through, this will be the third straight month of output cuts. When the production of crude oil is cut, the market price goes up.

This is bad for a country like India, which imports over 80 percent of all the crude oil it uses. If the price of crude oil goes up, the resultant spike in prices of petrol and diesel will make the current problem of inflation even worse.

The Indian government, which is bracing for elections in both states this year, and at the centre next year, has hinted that it would like to cut fuel prices to ease the burden on the consumers and voters. Last week, it announced a cut in price of cooking gas. However, a spike in crude oil prices may make this move less likely or more expensive for the exchequer.

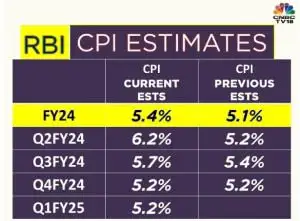

Meanwhile, the Reserve Bank of India has been clear that it intends to check inflation with more rate hikes, if necessary. India’s already facing high food inflation due to erratic rains and supply constraints. A spike in crude oil prices will only make it worse.

RBI tolerance level for consumer price inflation is 6 percent at worst. A spike in crude oil prices is not good for the Indian economy.

RBI tolerance level for consumer price inflation is 6 percent at worst. A spike in crude oil prices is not good for the Indian economy.

The latest consumer price index for July showed a rise of over 7.4 percent. If it gets worse, the Indian central bank may shift gears and return to a hiking interest rates, which equity markets don’t like.

Driving Naari Programme launched in Chandigarh

Driving Naari Programme launched in Chandigarh