Brokerage firm Bernstein has added Biocon, Reliance Industries, and Mahindra & Mahindra as part of the latest tweaks to its India portfolio.

Additionally, it has also removed hefty cash allocation and covered shorts.

Despite the volatility, a mix of positive factrs keeps Bernstein constructive on Indian equities for the June quarter. “However, this has yet to influence our view on full-year returns, which we are still calling to be flattish,” the brokerage wrote in its note.

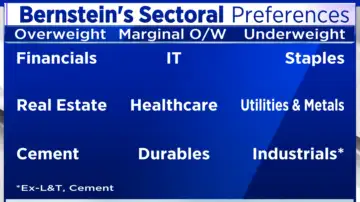

Bernstein expects the Nifty 50 to head back towards levels of 18,000 – 18,500 in the near-term, which will narrow some of the underperformance. The Nifty 50 has to trade above the mark of 18,197 to turn positive for the year. It expects financials, real estate and cement to do well.

Here are the 12 stocks now part of Bernstein’s India Portfolio:

Infosys: A contrarian pick from a strategy perspective on expectations of a weaker services environment as the US economy slows. Despite the recent weak results, Bernstein believes that Infosys is well positioned in the cloud/digital space and will benefit as demand recovers. It expects double-digit growth to return from financial year 2025. Valuations below the five-year average also keeps them constructive.

Zomato: The firm retained Zomato despite the potenial near-term risks ahead of results as it takes a slightly long-term view of he business model. While it expects near-term pressure on growth, it sees the duopoly structure and Zomato’s 50 percent market share with profitability levers keeping them constructive. It expects Zomato to benefit over the medium-term growth recovery and profitability.

HDFC Bank: India’s largest private lender has underperformed post the merger announcement with HDFC as investors worry about the impact of the merger on growth and profitability. Even as the merger creates short-term pressure on liabilities, Bernstein sees no risk to the bank’s core strength in deposit gathering or superior underwriting ability. It is also trading significantly below its long-term price-to-book average.

Axis Bank: The acquisition of the Citi franchise is a step in the right direction for Axis Bank, according to Bernstein. The brokerage believes that valuations will still be reasonable even if it does not see any significant gains from the Citi deal. A demonstration of successful integration or a capital raise at reasonable valuations could be near-term catalysts for the bank.

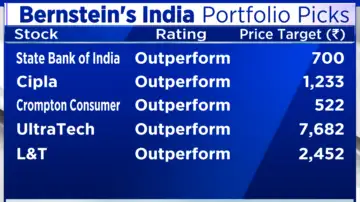

State Bank of India: India’s largest lender has the potential to see much lower cost-to-assets ratio compared to peers if it keeps the expense growth ratio under control, as per Bernstein. Value of SBI’s stake in its subsidiaries is nearly a quarter of its market capitalisation and provides a significant value-unlocking opportunity as its capital adequacy ratio is lower than peers.

Cipla: FDA observations at the Pithampur plant remains an overhang for the drugmaker and Bernstein says that longer the delay for gAdvair, the smaller the opportunity will get for them. However, the firm remains bullish on the stock after the significant de-rating in 2023 in anticipation of positive product catalysts in the US.

Crompton Consumer: Bernstein sees Crompton as a suitable buy at current valuations after having corrected 40 percent over the last 18 months. The brokerage calls Crompton a play for potential recovery in the small-value discretionary product demand, with moderation in inflatioon impacts. It also expects the Butterfly deal to add value with new product launches in the medium-term.

UltraTech: India’s largest cement player is Bernstein’s top pick within the sector even as it remains cautiously optimistic on the space overall. It expects UltraTech’s volumes to surprise positively this year, considering a pre-election year and capacity expansion. However, it fears a potential rollback of price hikes. Coal prices coming down will aid operating profit, or EBITDA.

Larsen & Toubro: The company’s scale and diversity gives it an unmatched advantage over peers to make the best use of the capex cycle, as per the note. Government capex, manufacturing, PLI schemes, and strong international order flows are likely to be the new growth drivers for the company.

Biocon: Bernstein recently upgraded Biocon to outperform based on positive changes in the US biosimilar market for generic players and the company’s near-term launch pipeline. It expects Adalimumab and Aflibercept to be big opportunities with Bevacizumab, Insulin Aspart and Human Insulin also being meaningful launches. Bernstein also finds Biocon’s valuations to be attractive.

Reliance Industries: Bernstein is reintroducing RIL to the strategy portfolio after removing it in January. The demerger of the financial services business can lead to potential IPOs of retail and telecom in the medium term and will be a strong positive catalyst. Its price target of Rs 3,210 implies a potential upside of around 35 percent.

Mahindra & Mahindra: Concerns over the rural market slowdown have led to M&M underperforming so far this year. With the stock reflecting a weak monsoon backdrop and favourable valuations, Bernstein highlights M&M as a key idea from the auto sector, despite being neutral overall.

Driving Naari Programme launched in Chandigarh

Driving Naari Programme launched in Chandigarh