Over the last five years, shares of Adani Enterprises have returned 7,446 percent to investors, surging from Rs 47 to Wednesday’s closing of Rs 3,547. The company’s annual report mentions that an investment of Rs 150 in the company’s IPO in 1994 would have turned into Rs 9 lakh at the end of FY22.

The stock will now become the newest entrant to the benchmark Nifty 50 index from September 30, becoming the second company of the Adani Group after Adani Ports to join the index.

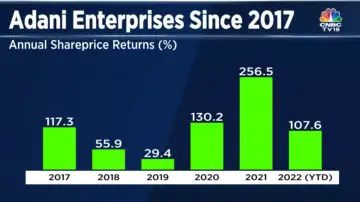

Shares of Adani Enterprises have doubled this year, gaining 107 percent so far. In fact, they have doubled in four out of the last six years.

According to Edelweiss Alternate Research, Adani Enterprises will have a total weightage of 1.3 percent on the Nifty 50 and will have inflows worth $336 million as part of the bi-annual rebalance of the index of India’s top 50 companies.

Adani Enterprises calls itself “India’s largest and most successful listed business incubator.” It has business interests spreading across airport management, roads, data centre, solar manufacturing, aerospace, defence, mining and many others. The company also has subsidiaries like Adani Transmission, Adani Power, Adani Ports & SEZ, Adani Green Energy, Adani Total Gas, and Adani Wilmar, which are listed and part of various bourses.

Based on the company’s June quarter shareholding pattern, promoters hold 72.3 percent stake in the company. Other stakeholders include India’s Life Insurance Corporation and Foreign Portfolio Investors like Nomura Singapore and Elara India Opportunities Fund.

Also Read: Gautam Adani’s fortune fails to halt rout in his business group bonds

In FY22, the company’s consolidated revenue grew to Rs 70,433 crore from Rs 40,291 crore in FY21.

Shares have delivered positive returns every year starting 2017, yet, not many mutual funds nor analysts have coverage of the company. However, there are exceptions to this as well.

Mumbai-based Quant Quantamental Fund, which has assets worth over $11.3 million, has 15 percent of its portfolio concentrated in two Adani Group companies – Adani Ports & Adani Enterprises. While many on the street, including rating agencies like Fitch, have questioned the company’s debt-backed expansion, Quant’s founder & CIO Sandeep Tandon thinks otherwise. “It is not just about looking at the leverage aspect. The market is not looking at the potential cashflows,” he told Bloomberg in an interview.

Based on Bloomberg data, Adani Enterprises is tracked only by two analysts, one with a neutral rating while the other has a buy recommendation. In a report dated July 5, 2022, Ventura Securities termed Adani Enterprises as “the goose that lays golden eggs.” It also mentions that the demerger of other businesses will result in significant value unlocking. It also expects the airport business to be the next value unlocking play for the company.

Shares of Adani Enterprises opened 2.9 percent higher on Thursday, September 29, trading at Rs 3,646 as of 9:30 am.

Driving Naari Programme launched in Chandigarh

Driving Naari Programme launched in Chandigarh