New Delhi, August 16

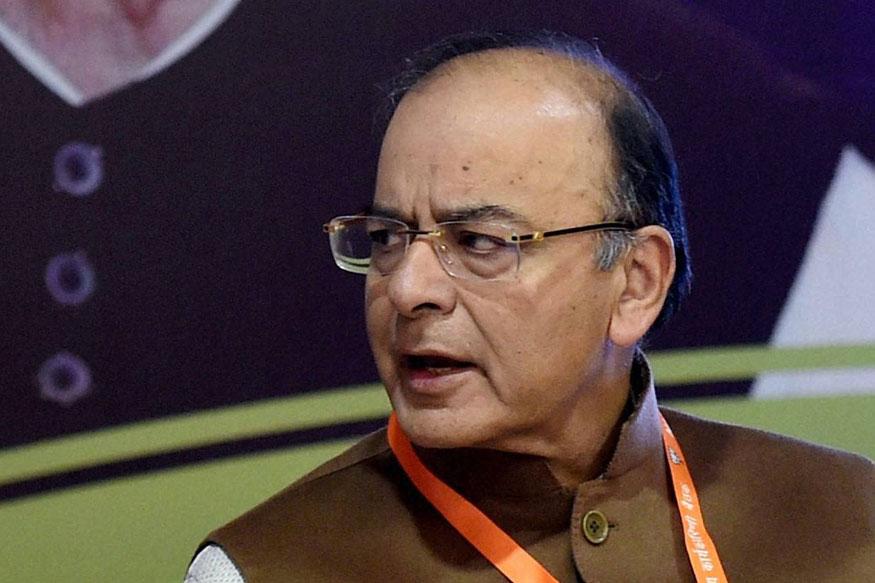

Industries in the north eastern and Himalayan states will continue to get tax exemption till March 2027, albeit as refund, under the current GST regime which was rolled out on July 1, Finance Minister Arun Jaitley said on Wednesday.

“Within the framework of the GST Act each industry will be entitled to its own refund mechanism during this particular period (March 31, 2027),” he said after the Cabinet meeting headed by Prime Minister Narendra Modi.

Industries in the north eastern and Himalayan states of Jammu and Kashmir, Himachal Pradesh and Uttarakhand under the previous excise regime used to get 10-year exemption, he said.

As per the scheme, industries which commenced operations during the period got excise tax holiday for 10 years, he said, adding that there is a separate residuary period for every industry because of commencement of production and their consequent entitlement of 10 year exemption.

Under the new Goods and Services Tax (GST) regime, there is no provision for exemption but there is one section under the Act which permits refunds.

“Therefore, refund would be permitted through DBT. The sunset clause of these exemptions has been extended to 2027.

A total of 4,284 industrial establishment will entitled to this benefit. Budgetary provision for this is Rs 27,413 crore,” he said.

Girls again, clinch top three spots in Class X PSEB exams

Girls again, clinch top three spots in Class X PSEB exams